WASHINGTON (AP) — The pressure on American households is growing as prices for everyday goods continue to rise, with President Donald Trump’s trade policies at the center of the debate.

The latest government report shows consumer prices increased 2.7% in August compared to a year ago, up from 2.4% in July. Month-to-month, prices ticked higher by 0.3%. Families are noticing it most at the grocery store, on furniture, and in appliances — essentials that are harder to cut from a budget.At the same time, wages only rose 0.3% in August, leaving workers struggling to keep up. Adjusted for inflation, paychecks have basically stalled.

Economists widely point to Trump’s tariffs as a key driver of these costs. By raising taxes on imports from countries like China and Europe, the administration has made goods across the supply chain more expensive. Some analysts warn that if the tariffs remain in place, consumer inflation could rise more than a full percentage point next year.

The Federal Reserve now faces a difficult decision: whether to cut interest rates to support a slowing job market or keep rates higher to fight rising prices. Either way, households will feel the impact.

Public opinion is also shifting. A recent AP-NORC poll found that most Americans expect costs to keep climbing as a direct result of Trump’s economic approach. Support for his handling of trade and the economy has slipped, with only about four in ten approving.

For companies, the tariff impact is mixed. Industrial businesses have been open about passing along higher prices to customers, while retailers are trying to hold off increases by relying on stockpiled inventory. Still, the pressure is building, and sooner or later, consumers will bear the brunt.

With kitchen-table costs rising faster than wages, the squeeze on American families underscores just how much policy decisions in Washington can shape the daily cost of living.

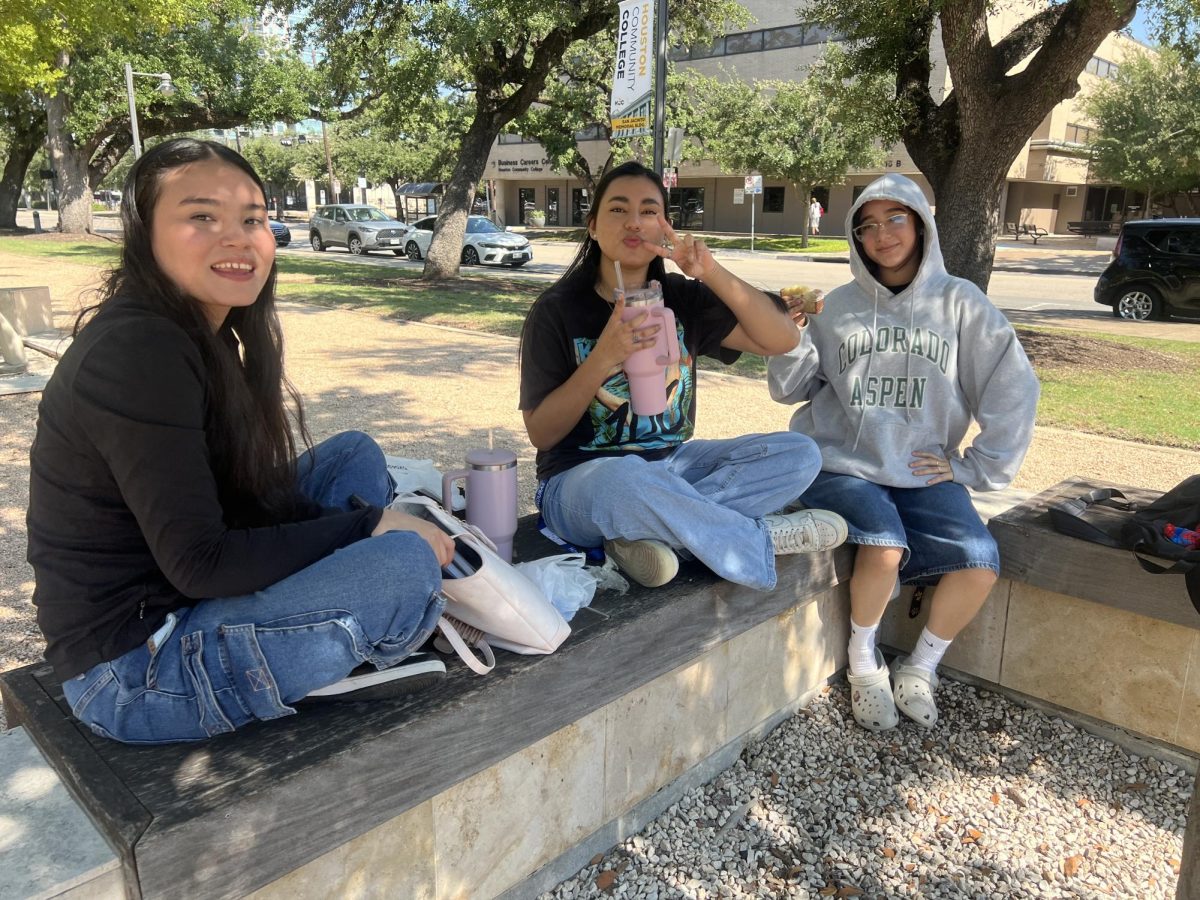

One thing very clear: While Wall Street and politicians debate numbers and strategies, everyday people are the ones carrying the weight of these policies. Families can’t shop their way out of tariffs. Working people can’t negotiate for cheaper groceries or medicine. And when wages stay flat while the cost of living rises, it’s ordinary households who are forced to cut back, delay bills, or go without.

Policies like tariffs are often framed as tough bargaining tools in global trade — but at ground level, they function like an invisible tax on the middle and working class. The wealthiest Americans may barely notice, but for families already living paycheck to paycheck, every price hike is a reminder of how far removed leadership in Washington can be from the realities of daily life.

If we truly care about fairness and opportunity, then economic policies need to be measured not just by charts and indexes but by the lived experience of the people most affected. Until then, the gap between political rhetoric and grocery store reality will only keep growing.

The debate also raises questions about who ultimately benefits from Washington’s policies. Tariffs are often promoted as a way to protect U.S. industries, but the benefits for companies have not always translated into gains for workers. For many households, the impact is more immediate: higher costs at the supermarket and in monthly bills. Economic policy, analysts note, is not abstract — it is reflected in everyday expenses.

If wages fail to keep pace with inflation, the promise of stability for working families becomes harder to maintain. Lower-income communities, in particular, are facing sharper effects, as they have less flexibility to absorb rising costs. On Wall Street, stock markets have remained resilient, with indexes climbing near record highs, even as Main Street families feel more pressure. Economists warn that this split between strong markets and household strain could widen the gap between higher- and lower-income Americans. The long-term outcome, they say, will depend on whether tariffs remain in place and how policymakers respond to the challenges of balancing growth with price stability.